What We Do

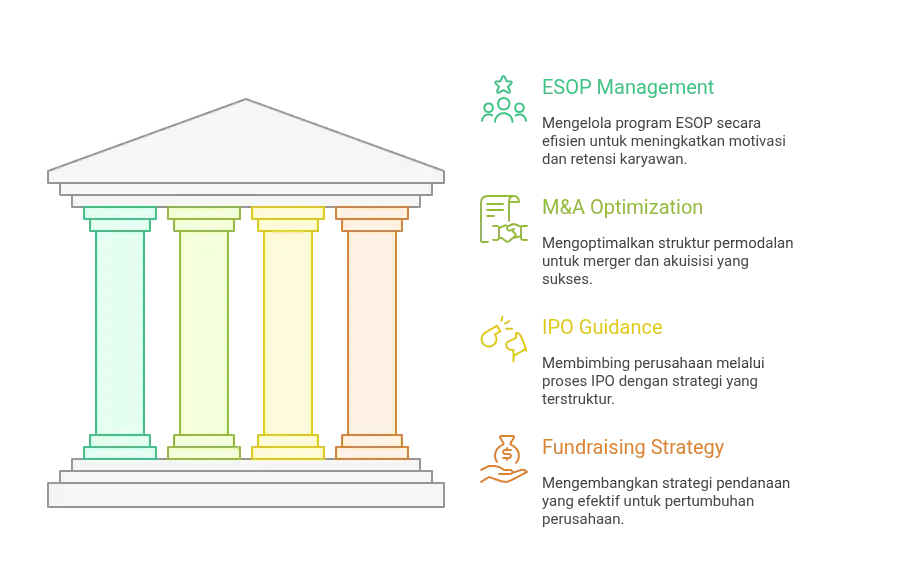

In today's digital era, effective management of ownership and capital has become a key element determining the success of an organization. Matasigma is here to support companies in achieving these goals through innovative solutions that combine the expertise and knowledge of experts with artificial intelligence systems.

artificial intelligence systems.

Our services are specifically designed to meet various strategic needs, optimizing the resilience and financial capabilities of companies.

Time and Cost Efficiency in ESOP Management

- Automation of the vesting, exercise, and reporting processes reduces administrative time by up to 80%, allowing companies to focus on business strategy.

- Data processing for reports to directors/investors can be done in a matter of hours instead of days, increasing time efficiency and reducing HR costs.

Increased Employee Engagement & Motivation

- 83% of employeesreport increased motivation after real-time access to stock ownership (client survey).

Matasigma enables companies to design, administer, and manage ESOP programs efficiently through our AI-based platform. This platform not only provides easy access for employees to monitor their stock ownership but also helps companies maximize the ESOP program as a strategic tool to enhance employee motivation, retention, and performance..

Target achievements to be reached

Matasigma's Agentic AI conducts in-depth mapping of your ownership structure, identifying potential synergies, and projecting the financial impact of various acquisition or merger scenarios. Based oninsightsfrom Agentic AI and input from expert consultants, we assist in the necessary restructuring of ownership and facilitate the process.due diligenceby providing transparent and verified data.

Target achievements to be reached

Cost Efficiency and Spending Optimization

Matasigma helps you optimize spending by providing accurate, data-driven analysis, allowing you to make more precise and effective decisions in the due diligence process.

Increase in Company Value Up to 35%

- Optimization of capital structurereducing capital costs by 2-3% and increasing ROE by 15-20%.

- Realization of synergypost-M&A increases company valuation by up to 35%.

Prepare your company for an IPO with comprehensive guidance from experts in corporate finance and capital markets. We use technologyArtificial Intelligence (AI)to provide more accurate and in-depth analysis. By usingAI-powered analysis, we will evaluate and map the organizational and management structure, analyze and refine corporate governance, and develop a structured, data-driven transformation roadmap. We will also conduct an analysis of operational, financial, marketing, and sales performance, as well as identify areas for improvement and growth opportunities.

Achievement targets to be reached:

- Increasing the company's readiness for an IPO: We help your company achieve IPO readiness by increasing company maturity by 30-50% through evaluation and mapping of organizational and management structures, analysis and refinement of corporate governance, and the development of a structured and data-driven transformation roadmap.

- Increasing pre-IPO profitability: We help increase pre-IPO profitability by 20-35% through optimization of key functions and identification ofvalue creation levers.

- Reducing compliance gaps with stock exchange regulations: We help reduce compliance gaps with stock exchange regulations by up to 90% through gap mapping and proactive action plans.

- Increasing appeal to potential investors: We help increase appeal to potential investors by enhancing transparency and quality of company performance, developing credible and data-driven valuation projections, and preparing effective and persuasive investment materials.

Dapatkan akses ke modal strategis yang ideal untuk mempercepat pertumbuhan bisnis Anda. Agentic AI Matasigma melakukan analisis mendalam terhadap lanskap pendanaan, baik domestik maupun global, untuk mengidentifikasi investor dengan strategic fit tertinggi dan memprediksi kesuksesan kemitraan jangka panjang.

Achievement targets to be reached

- Increasingfundraising process efficiency by up to 40%, in terms of time and resources required.

- Increasinginvestor closing success rate by up to 50%throughdata-driven precision targeting. yang presisi berbasis data.

- Minimizingequity dilution by 15–20%through simulations of optimal funding structures and realistic valuations.

With a structured approach and advanced AI Agent technology, Matasigma helps companies address complex challenges in ownership, capital, and funding planning, ensuring your readiness for every strategic step ahead..

Our Clients

- Startups & Rapidly Growing Companies:Managingcap tablewhich is becoming increasingly complex post-funding rounds (Seed, Series A, etc.) to ensure readinessdue diligenceand maximum appeal in the eyes of investors in the next funding round.

- Companies with ESOP/MSOP Programs:Automating the management of complex employee stock schemes, fromvestingto administration, to enhance talent retention and mitigate the risk of errors.

- Companies with Revenue >Rp 10 Billion Planning Expansion:Preparing a solid capital structure and governance to support expansion plans, whether through strategic fundraising, acquisitions, or internal optimization for organic growth.

- Companies Preparing for Corporate Actions (M&A/IPO):Ensuring that the entire ownership structure and company data are managed professionally, transparently, and ready for an intensivedue diligenceprocess, thereby maximizing valuation during the transaction.

- Companies with Complex Ownership Structures:Providing a single source of truth (single source of truth) to manage various classes of shares, conversion instruments, and warrants, eliminating ambiguity for all stakeholders.

By using this service, private companies can manage one of their most important assets and aspects (ownership structure) more professionally, accurately, and efficiently, ultimately supporting their growth and readiness for the future.

Case Study

Client:PT. Sentosa Raya Tbk. (SRA)

Challenges:PT. Sentosa Raya Tbk., a leading consumer products manufacturing company that has long been listed on the Indonesia Stock Exchange, faces challenges in maintaining growth momentum and optimizing value for public shareholders. With a complex ownership structure involving institutional, retail, and foreign investors, as well as the need to continuously innovate and expand, PT. SRA requires advanced tools to:

- Dynamically monitor and manage the post-IPO capital structure.

- Identify opportunitiesfor value creationsustainably across various business lines (operations, finance, marketing, sales) that can enhance stock performance and attract new investors.

- Ensure transparency of ownership data and strict regulatory compliance for public reporting and investor relations.

- Evaluate the potential impact of strategic corporate actions such as acquisitions, divestitures, or the issuance of new shares on valuation and equity structure.

Solution:PT. Sentosa Raya Tbk. implements solutions to support the company's value optimization strategy and capital management as a public entity.

- Conducting continuous mapping and monitoringof all ownership instruments andthe complex cap table,ensuring real-time data accuracyfor internal and external needs. untuk kebutuhan internal dan eksternal.

- Collaborating with strategy consultant, Agentic AI to deeply analyze operational, financial, marketing, and sales data to identify areas that need optimization to drive improvements in profitability, efficiency, and competitiveness, which are at the core of the strategy of value creation and sustainability.

- Facilitating internal improvements recommended by consultants, ensuring that business processes and data align with the goal of enhancing the company's value for public shareholders.

- Providing scenario simulations for various corporate actions (e.g., issuance ofrights issue, subsidiary acquisitions) with accurate projections of the impact on ownership structure and stock valuation.

- Presenting transparent and structured ownership information to support investor information needs, annual reports, and capital market regulatory requirements.

Results:

- Achieving more efficient and proactive capital structure management, enabling quick decision-making in response to market dynamics.

- Thanks toinsightfrom Agentic AI, PT. SRA successfully identified and implemented optimization initiatives across various business functions, which directly contributed to improvements in key performance metrics and the perception of the company's value in the eyes of investors.

- Enhancing transparency and accuracy of ownership data, strengthening investor confidence and facilitating compliance with reporting obligations to regulators and the public.

- Having strong analytical capabilities to evaluate and plan future corporate actions, ensuring that each strategic step provides maximum value for shareholders.

How to Start

The Matasigma work process is designed as a measurable outsourced service, ensuring you only pay for the results you achieve. Here are the stages:

- Log in to your Matasigma account. If you do not have an account, you can create a Matasigma account first

- Upload Requirements or Create TOR:Start by uploading your requirements document or create a Terms of Reference (TOR) directly on our smart platform.

- AI Assistance in Creating ToR: Utilize Matasigma AI to develop a comprehensive and targeted ToR.

- Get Price Quotes: Receive competitive and transparent price offers.

- Approve and Start: Approve the offer, and our team of experts is ready to assist.

FAQ

- What is a Terms of Reference? A Terms of Reference, often referred to as Terms of Reference (TOR), is a document that defines the scope, objectives, expected outcomes, responsibilities, timeline, and other requirements of a project, study, or work to be done. In short, the TOR serves as an official guide that explains what needs to be achieved, how the work should be done, and who is responsible for it.

- What is the cost of Matasigma services? The cost of Matasigma services varies depending on the needs and complexity of the implementation to be handled by AI Agent and Agentic AI. Please open a Matasigma account and consult your needs to get a quote with the provided AI-based Analyst.

- Is Matasigma compatible with existing systems? Matasigma is designed to integrate with various existing systems. Our team will conduct an assessment to ensure compatibility and smooth integration.

- How long does the implementation take? The implementation time varies depending on the scale and complexity of your business. However, our team will work closely with you to ensure an efficient and swift process.

- What support is provided after implementation?We provide comprehensive technical support and customer service, including training, maintenance, and technical assistance via phone, email, and access to an online support portal.